Article

Risk and opportunity management system at Deutsche Telekom

As one of the world’s leading providers in the telecommunications and information technology industry, we are subject to all kinds of uncertainties and change. In order to operate successfully in this ongoing volatile environment, we anticipate potential developments at an early stage and systematically identify, assess, and manage the resulting risks and opportunities. We therefore consider a functioning risk and opportunity management system to be a central element of value-oriented corporate governance.

A risk and opportunity management system of this kind is not only necessary from a business point of view; it is also required by laws and regulations, in particular § 91 (2) and (3) of the German Stock Corporation Act (Aktiengesetz – AktG). Deutsche Telekom AG’s Audit Committee monitors the effectiveness of the internal control system and the risk management system as required by § 107 (3) sentence 2 AktG.

Our risk and opportunity management system is based on the globally applicable risk management standard of the International Standards Organization (ISO). ISO standard 31000 “Risk management – Principles and guidelines” is regarded as a guideline for internationally recognized risk management systems. And our Group-wide risk management policy serves as the basis for a uniform risk management methodology.

The Group Risk Governance unit defines the methods for the risk and opportunity management system that is applied Group-wide and for the associated reporting system, in particular the Group risk report. All operating segments as well as the Group Headquarters & Group Services segment are connected to the central risk and opportunity management system of the Group via their own risk and opportunity management. The relevant owners in each of the segments are responsible for identifying, assessing, and continuously monitoring risks. Management takes potential opportunities into account in the annual planning process and continuously develops them further during business operations.

Our Group-wide risk and opportunity management system covers strategic, operational, regulatory, legal, compliance, and financial risks and opportunities for our consolidated and major non-consolidated entities.

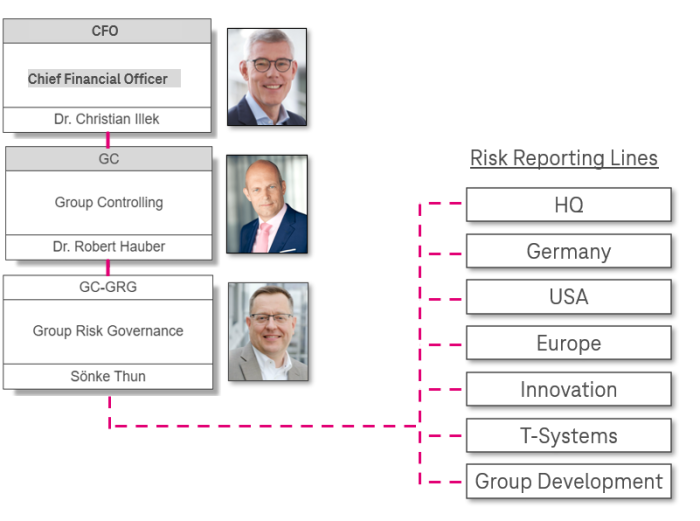

Dr. Robert Hauber is Senior Vice President Group Controlling at Deutsche Telekom and therefore also responsible for Group Risk Goverance. He is our Chief Risk Officer.

Group Risk Governance belongs to the finance team. The Vice President of Group Risk Governance (GRG), Sönke Thun, reports directly to the Senior Vice President of Group Controlling, Dr. Robert Hauber, who is also the Chief Risk Officer. In turn, Robert reports directly to the Chief Finance Officer (CFO), Dr. Christin Illek.

GRG is responsible for the risk management system and provides a standardized framework, reporting process, methodology and training for the entire footprint of Deutsche Telekom.

Furthermore, all the business lines, including the board area finance, have direct risk reporting lines to GRG and have designated contacts. All The decentral risk managers in the organization's units and subsidiaries also collaborate with the respective risk management units mostly structured under the financial director/CFO areas.

Additionally, GRG has a link to the audit committee and answers any inquiries concerning the integrity of the risk management system.